Cryptocurrency, Epstein and the Bullshit Asymmetry Principle

The silver lining: “The amount of energy needed to sustain bullshit *that is obvious to all* is an order of magnitude bigger than that needed to produce it.”

I finished reading Number Go Up, Zeke Faux’s romp through the Bitcoin bubble, this weekend while recovering from COVID. I highly recommend it if you’re looking for an entertaining guide to the whole Ponzi scheme scene, which was best explained by none other than Sam Bankman-Fried back when he was still a free man (see below for details). The fact that there is no economic justification for cryptocurrency, other than to make it easier for people to speculate on the gullibility of other people, as well as to hide illegal transactions, didn’t stop the US House from voted 308 to 122 to pass the so-called GENIUS Act last week. The legislation (which had already passed the Senate and which the Orange Cheeto promptly signed) blesses the entirely unnecessary market for “stablecoins,” forms of crypto that supposedly are backed by US dollars—“thereby paving the way for future scams and financial crises,” as economist Paul Krugman put it. Seriously, if you have any friends or colleagues who are into crypto, run the other way. Find new friends.

Why did the GENIUS Act move through Congress like a dose of salts (as my old friend Robert Sherrill memorably described other acts of legalized looting, like the deregulation of the savings and loan industry in the 1980s)? Because the path was greased with nearly a quarter billion in industry donations to members and independent spending last cycle, and the big crypto PACs waved equally large warchests in front of members now, vowing to use the money this cycle. More depressingly, or predictably, every member of the House Democratic leadership voted for the bill, along with nearly half their caucus. (102 Dems voted in favor, vs 110 against.)

Banking is one of those subjects that probably makes your eyes glaze over, but trust me on this: making it easier for all kinds of institutions to issue their own “currencies” (even if they have the magic word “crypto” as a prefix) and to make claims about their stability, relying on overworked and understaffed federal regulators (and in many cases similarly attenuated state regulators, for smaller offerings) to issue clean bills of health – when the President himself (and his family) corruptly speculates in the very same product his government is supposedly also regulating – is not a recipe for financial stability or security. During the so-called Free Banking Era of the 1830s to the Civil War, banks, which were regulated by the states, were also able to issue their own currencies, and there were constant bank runs and collapses. (Here’s a gift link to the one thing you need to read about this period, if you doubt my word.)

If you identify with the Defiance and live in a blue district, just remember this: the odds that your own elected Democratic House rep voted for this garbage are nearly 50-50. Sometime in the future, when the next financial crash happens, their vote to bless the crypto industry will be remembered, the same way we remembered who voted back in the late 1990s to eliminate the Glass-Steagal Act preventing banks from merging with financial firms, a Robert Rubin/Bill Clinton special that helped drive the Great Recession of 2008. Saving my local readers a step: the Congressman from one of the poorest districts in America, Ritchie Torres, a total crypto shill, voted yes, as did my Rep. George Latimer, a shmendrick[1] who was helped in 2024 by $2 million in outside spending from FairShake, one of the biggest independent crypto PACs).

Dealing with Brandolini’s Law

Somewhere in the middle of Number Go Up, Faux quotes Alberto Brandolini’s Bullshit Asymmetry Principle, which I had not heard of until now, and I thought, “This right here explains it all.” Brandolini’s Law states, “The amount of energy needed to refute bullshit is an order of magnitude[2] bigger than that needed to produce it.” Learning this alone made me glad I forked over $17 to buy Faux’s book.

The problem is what to do when you see bullshit everywhere but don’t have the time to or energy to rebut it. Because it turns out when you don’t have actual competence or facts behind you, bullshit can get you very far.

For example, Monday, the longtime head of FEMA’s urban search and rescue unit resigned, describing the agency as being in “chaos” and blaming bureaucratic hurdles imposed by the Department of Homeland Security preventing the spending of any amount over $100K without express approval of DHS czarina Kristy Noem that delayed the agency’s response to the recent deadly floods in Texas. A spokeswoman for DHS, Tricia McLaughlin, responded, telling the New York Times (gift link), “It is laughable that a career public employee, who claims to serve the American people, would choose to resign over our refusal to hastily approve a six-figure deployment contract without basic financial oversight.” She added, “We’re being responsible with taxpayer dollars, that’s our job. Attempting to spin a personal career decision into some big scandal is ridiculous.” The bullshit is obvious, but McLaughlin’s past experience as communications director for Vivek Ramaswamy, one of the biggest bullshitters of the 2024 Republican primary, obviously qualified her for her new job at DHS.

I could pull up a list of quotes from any number of Trump Administration spokespeople and all of them would be similar. Trumpies don’t just deny stuff, they bluster. Here’s White House spokesman Steven Cheung this past spring criticizing former President Biden for charging Trump with endangering Social Security, for example: "President Trump has repeatedly promised to protect Social Security and ensure higher take-home pay for seniors by ending the taxation of Social Security benefits. Anybody saying otherwise is either stupid or an all-out liar, or both in Biden’s case.”

Here's another White House spokeswoman, Anna Kelly, responding to a report yesterday in the Washington Post that the Pentagon’s independent watchdog had found that Defense Secretary Pete Hegseth’s Signal chat messages previewing the US bombing campaign in Yemen were derived from a classified email labeled SECRET/NOFORN: “It’s shameful that the Washington Post continues to publish unverified articles based on alleged emails they haven’t personally reviewed in an effort to undermine a successful military operation and resurrect a non-issue that no one has cared about for months.”

But here’s the thing about what happens when your entire world is built on bullshit and bullshitting. When you get caught in a blatant contradiction, one so large that it can’t be waved away, the whole edifice gets very shaky. And that, I think, is why Trump’s current effort to cover up his relationship with convicted pedophile Jeffrey Epstein is so important. On the one hand, the Justice Department from Attorney General Pam Bondi on down has promised to get to the bottom of the Epstein case, release all the files, and go after anyone who has committed crimes against victims. They’ve done so with bluster. But then they’ve also claimed the case was closed, also at the behest of the President, who has begged his followers to move on.

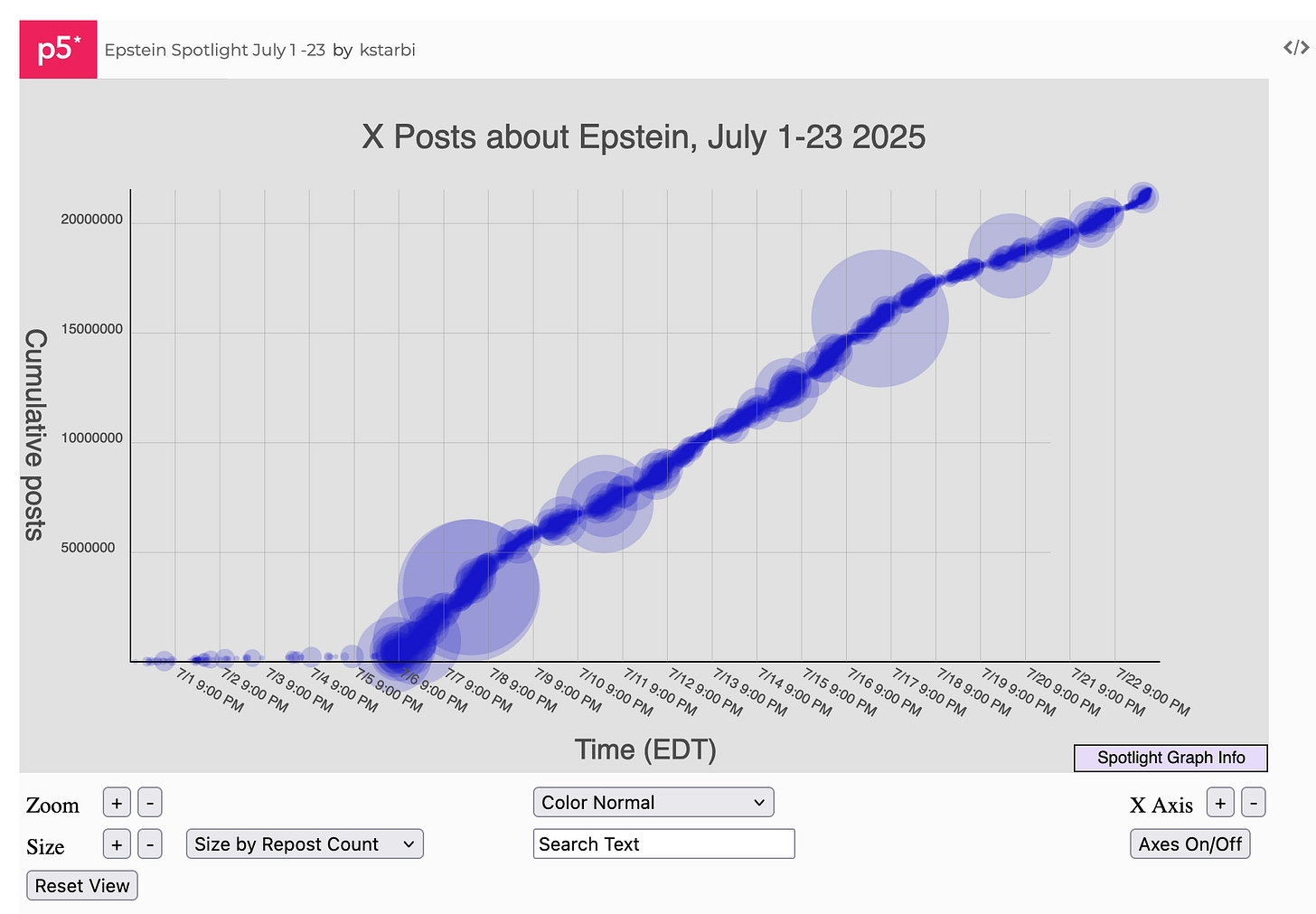

So far, they aren’t. Number go up, indeed!

Many of Trump’s minions owe their rise to fame and fortune on the relationship they’ve built with their online audiences, something they’ve cultivated in large degree by feeding and ratifying their belief in conspiracy theories. As the Wall Street Journal noted yesterday, “The decision to not release the files and the harsh fallout among the public has roiled some of Trump’s senior staff, who have staked their reputations on exposing the ties between Epstein and moneyed elites. [Kash] Patel, the FBI director, and his deputy, Dan Bongino, had been in favor of releasing more documents, people familiar with their efforts said. Bongino has told colleagues that his association with the administration’s decision to keep the files private has eroded his credibility among the base of support that fueled his rise as a successful podcaster and media personality on the right, according to a senior administration official.” In other words, Bongino—an online influencer who had no qualification to be deputy FBI director other than his slavish loyalty to Trump—is now caught between what he believes he has to do to keep his audience and to maintain his position with Trump.

According to a new Fox News poll, “Only 13% think the government has been open and transparent about the Jeffrey Epstein case, while more than five times as many, 67%, disagree – including 60% of Republicans and 56% of MAGA supporters. One voter in five says they haven’t been following the case.” That means 80% of the public is paying attention. Hence the Trump regime’s sudden move to release files on Martin Luther King Jr. and to try shine attention on Barack Obama’s investigation of Russian efforts to interfere in our elections. As Andrew Egger put it in the Bulwark, “The worse the Epstein revelations, the wilder the distractions issued to try to get the MAGA faithful to look literally anywhere else.”

The opposite of the bullshit asymmetry principle might be phrased thus: “The amount of energy needed to sustain bullshit that is obvious to all is an order of magnitude bigger than that needed to produce it.”

The Mother of All Bullshitters

Here’s how Sam Bankman-Fried essentially admitted that crypto was a Ponzi scheme back in 2022 (when everyone in Washington was hungry for his money), from his conversation then with Bloomberg’s Matt Levine:

Matt Levine: “Can you give me an intuitive understanding of [yield] farming? I mean, like to me, farming is like you sell some structured puts and collect premium, but perhaps there's a more sophisticated understanding than that.”

Sam Bankman-Fried: “Let me give you sort of like a really toy model of it, which I actually think has a surprising amount of legitimacy for what farming could mean. You know, where do you start? You start with a company that builds a box and in practice this box, they probably dress it up to look like a life-changing, you know, world-altering protocol that's gonna replace all the big banks in 38 days or whatever. Maybe for now actually ignore what it does or pretend it does literally nothing. It's just a box. So what this protocol is, it's called ‘Protocol X,’ it's a box, and you take a token. You can take Ethereum [a cryptocurrency], you can put it in the box and you take it out of the box. Alright so, you put it into the box and you get like, you know, an IOU for having put it in the box and then you can redeem that IOU back out for the token.”

”So far what we've described is the world's dumbest ETF [exchange traded fund] or ADR [American depository receipt] or something like that. It doesn't do anything but let you put things in it if you so choose. And then this protocol issues a token, we'll call it whatever, ‘X token.’ And X token promises that anything cool that happens because of this box is going to ultimately be usable by, you know, governance vote of holders of the X tokens. They can vote on what to do with any proceeds or other cool things that happen from this box. And of course, so far, we haven't exactly given a compelling reason for why there ever would be any proceeds from this box, but I don't know, you know, maybe there will be, so that's sort of where you start.”

”And then you say, alright, well, you’ve got this box and you’ve got X token and the box protocol declares, or maybe votes by on-chain governance, or, you know, something like that, that what they're gonna do is they are going to take half of all the X tokens that were re-minted. Maybe two thirds will, two thirds will offer X tokens, and they're going to give them away for free to whoever uses the box. So anyone who goes, takes some money, puts in the box, each day they're gonna airdrop, you know, 1% of the X token pro rata amongst everyone who's put money in the box. That's for now, what X token does, it gets given away to the box people. And now what happens? Well, X token has some market cap, right? It's probably not zero. Let say it's, you know, a $20 million market …”Levine: “Wait, wait, wait, from like first principles, it should be zero, but okay.”

Bankman-Fried: “Uh, sure. Okay. Completely reasonable comments.”

Levine: “I mean, that's not quite true, but, like, when you describe it in this totally cynical way, it sounds like it should be zero, but go on.”

Bankman-Fried: “Describe it this way, you might think, for instance, that in like five minutes with an internet connection, you could create such a box and such a token, and that it should reflect like, you know, it should be worth like $180 or something market cap for like that, you know, that effort that you put into it. In the world that we're in, if you do this, everyone's gonna be like, ‘Ooh, box token. Maybe it's cool. If you buy in box token,’ you know, that's gonna appear on Twitter and it’ll have a $20 million market cap. And of course, one thing that you could do is you could like make the float very low and whatever, you know, maybe there haven't been $20 million dollars that have flowed into it yet. Maybe that's sort of like, is it, you know, mark to market fully diluted valuation or something, but I acknowledge that it's not totally clear that this thing should have market cap, but empirically I claim it would have market cap.”

Levine: “I agree.”

Joe Weisenthal (podcast co-host): “It shouldn't have any market cap in theory, but it practice, they always do. Okay."

Bankman-Fried: “That's right. So, and obviously already we're sort of hiding some of the magic impact, right? Like some of the magic is in like, how do you get that market cap to start with, but, you know, whatever we're gonna move on from that for a second. So, you know, X tokens [are] being given out each day, all these like sophisticated firms are like, huh, that's interesting. Like if the total amount of money in the box is a hundred million dollars, then it's going to yield $16 million this year in X tokens being given out for it. That's a 16% return. That's pretty good. We'll put a little bit more in, right? And maybe that happens until there are $200 million in the box. So, you know, sophisticated traders and/or people on Crypto Twitter, or other sort of similar parties, go and put $200 million in the box collectively and they start getting these X tokens for it.”

”And now all of a sudden everyone's like, wow, people just decide to put $200 million in the box. This is a pretty cool box, right? Like this is a valuable box as demonstrated by all the money that people have apparently decided should be in the box. And who are we to say that they're wrong about that? Like, you know, this is, I mean boxes can be great. Look, I love boxes as much as the next guy. And so what happens now? All of a sudden people are kind of recalibrating like, well, $20 million, that's it? Like that market cap for this box? And it's been like 48 hours and it already is $200 million, including from like sophisticated players in it. They're like, come on, that's too low. And they look at these ratios, TVL, total value locked in the box, you know, as a ratio to market cap of the box’s token. [Emphasis added.]”

”And they’re like ‘10X that's insane. 1X is the norm.’ And so then, you know, X token price goes way up. And now it's $130 million market cap token because of, you know, the bullishness of people's usage of the box. And now all of a sudden of course, the smart money's like, oh, wow, this thing's now yielding like 60% a year in X tokens. Of course I'll take my 60% yield, right? So they go and pour another $300 million in the box and you get a psych and then it goes to infinity. And then everyone makes money.”Levine: “I think of myself as like a fairly cynical person. And that was so much more cynical than how I would've described farming. You're just like, well, I'm in the Ponzi business and it's pretty good.”

Joe Weisenthal: “At no point did any of this require any sort of like economic case, it’s just like other people put money in the box. And so I'm going to too, and then it's more valuable. So they're gonna put more money in, and at no point in the cycle, did it seem to like, describe any sort of like economic purpose?”

Bankman-Fried: “So on the one hand, I think that's a pretty reasonable response. …I think there's a depressing amount of validity.”

~

Maybe the fact that the words bullish and bullshit are so close to each other ought to be a clue, yes? And that so much of our financial system is based on the word confidence, but “confidence man” is not a word we trust?

Also Worth Reading

—I think Marcy Wheeler has the cleanest explanation of how we suddenly learned about Trump’s birthday letter to his pal Epstein. Ghislaine Maxwell, Epstein’s convicted collaborator, clearly has dirt on Trump that she’s leveraging to get herself some kind of get-out-of-jail deal.

—Ben Lorber explains in New Lines Magazine how MAGA’s obsession with Epstein is rooted in a deeply antisemitic worldview. The upshot: if Trump succeeds in suppressing the Epstein files, or if he’s truly damaged by them, either way a big chunk of MAGA will blame the Jews.

—Need a corrective to Trump’s newly announced “AI Action Plan”? Check out the People’s AI Action Plan, a consortium of dozens of public interest organizations led by the AI Now Institute.

—New research into Elon Musk’s Starlink internet service done by the X-Lab has found that the more people use the service, “the worse its speeds and reliability.” Gosh, it’s a good thing that the Trump administration has rewritten the rules governing how federal funds can be spent to expand high-speed internet access to insure that they give more weight to “low earth orbit” satellite technologies over fiber.

Don’t Miss:

The second episode of my new podcast This Old Democracy is now available. It’s a conversation with political scientist Lee Drutman on the topic, “How Can Multi-Party Democracy Reverse the Two Party Doom-Loop?” You can find it on Spotify or Apple Podcasts or wherever you get your fix. This episode, like the first one with Dan Cantor, is a good primer on how the structure of our two-party political system makes our politics worse than it needs to be.

End Times:

The great man gets the last word.

[1] Everyone should be forced to learn at least one new word a day. This is your chance.

[2] Ten times as much.

When I called my congressman, the Democrat John Mannion, to say I would no longer support him financially because of his vote for crypto, the person I spoke to said it was a shame to lose support over one issue, which tells me they don't understand how seriously wrong this is. He also voted for the Laken Riley act, another black mark.

Didn't have a crypto takedown on the cards this week but thank you 🙌